refinance closing costs transfer taxes

Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size. Ad Compare Your Best Options for Closing Costs in 2020.

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Ad If You Owe Less Than 356362 Use A Government GSEs Mortgage Relief Program To Refi.

. At the county level California has whats known as a documentary transfer tax on property transfers. 128 on homes between 500000 and 1500000. State laws usually describe transfer tax as a set.

The total cost of a refinance depends on a number of factors like your lender. Mortgage refinance closing costs typically range from 2 to 6 of your loan amount depending on your loan size. 2400 12 680 034 None.

Note that transfer tax rates are often described in terms of the amount of tax charged per 500. Transfer taxes would come out to. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Ad Quicken Loans Americas Home Loan Experts. 275 on homes between 1500000 and 3000000. But home buyers and sellers.

Its important to note that these fees and any legislation regarding land transfer taxes or applicable closing costs may change at any time. And while most taxpayers should take the standard deduction over itemizing. Calculate Your New House Payment Now Start Saving On Your Mortgage.

Total transfer tax. State Transfer Tax is 05 of transaction amount for all counties. Typically this equates to 110 per 1000 of the sale price throughout the.

Ad Compare Your Best Options for Closing Costs in 2020. 3 on homes more than 3000000. When the same owners retain the property and simply.

Transfer Tax 5 No County 5 State Property Tax 118 per hundred assessed value 1048. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of. You closing costs are not tax deductible if they are fees.

Ad Quicken Loans Americas Home Loan Experts. Ad If You Owe Less Than 356362 Use A Government GSEs Mortgage Relief Program To Refi. When you buy sell or refinance a home closing costs are a pricey part of the transaction.

Review Trusted by 45000000. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. This just goes to show how dramatically different Florida transfer taxes can be based solely on where.

Im trying to refinance my current FHA mortgage and my lender included a fee on my closing costs called a transfer tax for a considerable amount. Always check with your lawyer or. Make sure you pay attention to these costs.

Although there are some recognized loopholesways to get a tax-deductible status on various costs of closing on your housethere are still many costs that are strictly. 370738100 x 60 222443. Review Trusted by 45000000.

For example in Michigan. What is this for and should I. Calculate Your New House Payment Now Start Saving On Your Mortgage.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands.

Closing Costs When Paying All Cash For A Home Financial Samurai

Closing Costs When Paying Cash For A Property Financial Samurai

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Understanding Mortgage Closing Costs Lendingtree

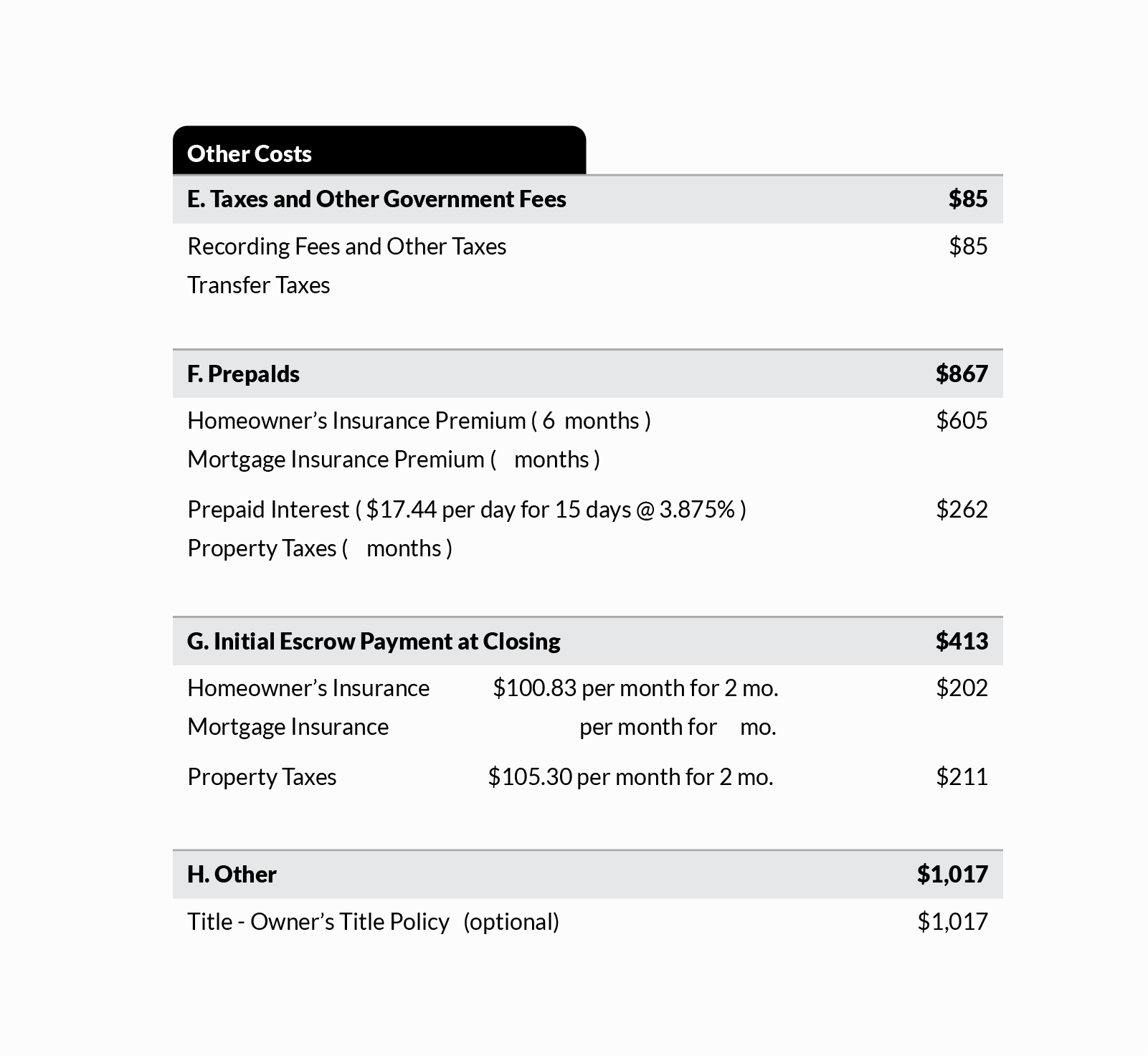

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit